I know I said I was done for the year; but I had a spark of inspiration and had to get this one out.

Most of you know I’m a lawyer; but I’ve dabbled in management over the years, and have a company called Thrive Sports + Entertainment through which I’ve provided management and consulting services. In 2024, I’ll be doing more of that; and, as a result, will be publishing less on this newsletter - but I’ll keep you updated.

This paper lays out the mission of Thrive Sports + Entertainment as it relates to the opportunity I see for creative entrepreneurs. When I say creative entrepreneurs here, I’m specifically referring to recording artists, athletes, actors and media personalities and influencers; and how they can build in this new era.

But, as I’ve written about before, I believe we all are artists and entrepreneurs, we simply express that in different ways (or don’t). A lot of people push back on that concept, but I stand on it. I’m a lawyer, a writer, an author of two books, have executive produced music videos, and A&R’d records.

I don’t think I’m special, I think I’m not afraid to do what I like.

But back to the point. In this paper, we’ll be looking at three main things:

The importance of creating space for creative entrepreneurs and how the “management function” can assist;

The importance of developing and leveraging creative enterprise strategies;

Financial implications, such as venture capital analysis, for creative entrepreneurs; and other considerations.

This is a long one, but because I’ll be doing less writing, this will serve as a reference and overview for anyone who wants to know what I or my company stands for in this space.

Let’s get into it.

IN THE KITCHEN, COOKING

One of the things I’ve focused on, up to this point, in my writing has been the intersection of music, media, technology and culture. This was borne out of my, often, schizophrenic career. I’ve worked in the nonprofit space, I’ve worked in law, I’ve worked in music and entertainment, and I’ve worked in tech; and one thing I’ve realized is that everything is connected.

When it comes to the business of creative entrepreneurs, this presents an opportunity if we analyze it through the scope of the value that individuals, with outsized influence, can provide to corporate, social, and even political entities. For instance, in my last article, I touched on the opportunity for creative entrepreneurs to build tech based companies.

A few weeks later Mr. Beast announced he was launching “an analytics platform ViewStats, which uses the YouTube API to unveil detailed stats about channels that both creators and their fans can see”; shortly after that, venture capitalist, Marc Andreessen announced that celebrity-led brands were the future of consumer products. Because of the power dynamics in media (music, sports, entertainment, news; etc.), there’s an outsized opportunity for those creative entrepreneurs (who break through) to build valuable brands and enterprises - even outside their native sectors.

I wrote about my own experiences with music industry power dynamics here:

That said, it’s a pretty obvious opportunity at this point; and artists, athletes, and high profile individuals have been doing it for decades. What has changed is the number of people who have become “influencers”, the increased access to capital, and the democratization and commoditization of complex and previously “gate kept” skills (engineering, law, finance; etc.). This has created an environment where there’s more noise and fugazi things; but, in a way, it’s easier to build than ever before.

In addition to that, entrepreneurship has always been a part of culture and media-infused sub-cultures: such as hip hop; and, increasingly there’s been a growing social awareness of the value that is created on top of creative entrepreneurs.

On the record, ‘Family Ties’, rapping alongside his cousin, and agency/record label signee, Kendrick Lamar said, “Dave Free got at least one B in the oven”. Also, during his ‘B-Sides 2’ concert at Webster Hall, Jay Z said “I told Neighborhood Nipsey stay close. There’s a 100 million dollars on your schedule, lay low”.

Cool lyrics aside, there is a lot of wisdom in these words. It’s probably impossible to tell how accurate those valuations are; but when you do the research on the brands, initiatives, and ventures that these artists (in addition to others, e.g. Kanye West) were and are building outside of music and the recurring income and influence they exert, it lends to the thinking, as we’ll discuss later, that there are outsized opportunities for them which are comparable, and often exceed, those of the traditional business founder.

Art is commerce.

This potential is further evidenced by other creators like Reese Witherspoon, Lebron James, Ryan Reynolds, Matt Damon and Ben Affleck who have all built businesses around their talent and profile; securing large valuations to varying degrees of success. As I discussed in this article, below, creative entrepreneurs are media executives; in the vein of Walt Disney.

The key, in most of those instances, is that these creative entrepreneurs partnered with individuals (see: specialists) and corporate stakeholders who were able to help them identify, measure, manage, and advance ancillary enterprise opportunities; securing large valuations for their companies and brands. So then the multi-million or billion dollar question is how does one build those enterprises and get to those valuations?

If it were that easy, everyone would do it; but I have a few thoughts.

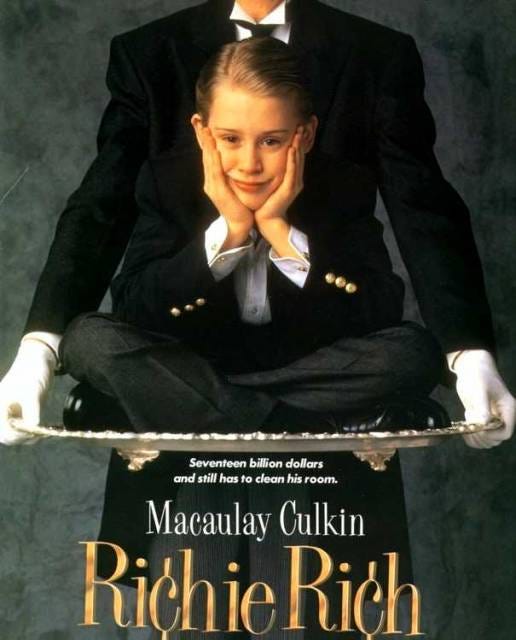

RICHIE RICH

In ‘The Operator’ which chronicles the life of, media mogul, David Geffen, one of the recurring themes is the way he ran his record label(s). He was an “artist friendly” executive who gave his artists space and time to be creative, often eschewing the short term thinking, deadlines, and (over)adherence to the financial metrics of the “bean counters” and record executives. While the bean counters are necessary; David’s approach resonates with me because if there’s anything I’ve learned in my career it’s that what most people need is the exposure, space and opportunity to leverage their unique talents and abilities.

I started my legal career at 25, at a small law school in Atlanta; and as an immigrant who didn’t have a work permit and virtually no formal work experience; yet 10 years later, at 35, I’ve been negotiated multimillion dollar transactions and worked with several very large companies.

Where I didn’t have the network, experience, and finances of some of my peers; I made up for it with drive, discipline and vision (+ God’s grace). I don’t think I’m special in that regard; I think I just used what I had, and was privileged to receive the opportunities to advance. Opportunities that many don’t receive.

I believe many creative entrepreneurs need this same opportunity, in addition to applying their own individual drive, discipline and vision. This is an area where a new age, or evolved, management team (or function) can assist. This management function can help to scope the opportunity, create the environment for these creative entrepreneurs to thrive. I wrote a bit about my concept of “management” and building teams here:

A pop culture example is the movie ‘Richie Rich’, which is about a kid who grows up rich and privileged. From a young age he’s groomed to understand corporate governance, high-finance, and commercial enterprise dealings in general; so when his father’s plane is blown out of the air by a CFO who wants to take over the business, Richie is able to step in as the CEO at 12 years old. Meanwhile, his peers are playing baseball in an abandoned lot (something he realized he would rather be doing). Along the way, Richie befriends these kids; and chaos and hostile takeover maneuvers ensue.

Goofiness aside, Richie is able to thwart the opponents of his father’s business due to the help of his friends; and, at the end of the movie, Richie creates a baseball field in his huge back yard for he and his friends to play.

The lesson I'm drawing from this children’s movie is that even though they had not grown up in his environment, it didn’t take long for Richie’s friends to become acclimated to his environment and assets to his enterprise. His family’s business would have been lost without them.. because even though Richie had grown up rich and privileged, things change; and sometimes you need more than book smarts to adapt.

A space and network for creative entrepreneurs which grants them the time to develop, exposes them to new, cutting edge (and relevant) information and access to resources and power players is part of what I think needs to be built; and is something I believe I’m perfectly positioned to help build.

As a kid, my mother took me out of public school and put me into a private high school after my dad left because she didn’t want me to get in trouble (still got in trouble). And so I attended private school with people whose lives looked like a little like Richie Rich’s - so I understand how that side of the track thinks; but my personal life also had a few similarities to another Richie Rich - and so I find myself somewhere in the middle-ish.

On the other side of the tracks, Oakland rapper Richie Rich (pictured above w/ Tupac) once rapped:

Certain niggas wanna stick to the game, you's a trick to the game

Waitin' upon your turn, son when will you learn?

Ain't no turns given, niggas be twistin' and takin' shit

Puttin' they sack down, then puttin' they mack down- Richie Rich, ‘Heavy in the Game’

Let’s break these lyrics down:

Richie’s saying that certain people blindly follow what they’ve been told (rules of the game) without questioning whether they’re right or right for them. They think by doing so, they’ll be rewarded.

Maybe, or maybe you just end up being taken advantage by those who realize life is not that clear cut.

Maybe you’ll end up waiting on a turn that never comes..

..because audentes Fortuna luvat - Fortune favors the bold

In Richie Rich’s eyes, he would rather play his own game. As Albert Einstein said, “first you have to learn the rules, then you break them”. Yes, there’s a way things operate and you should understand that; but once you understand, you should evaluate how you want to operate and where the gaps exist.

This is also discussed in the book Blue Ocean Strategy which basically says that entrepreneurs shouldn’t compete where the market is full of competition (red oceans); and should instead find spaces that are free of competition (blue oceans).

So the lesson is rather than blindly following a pre-existing game, play your own game. Develop your own plan. Understand what it takes and become as self-sufficient as you can.

That’s something both Richies got right.

And it’s something creative entrepreneurs will have to increasingly understand, navigate, and apply. When you read the current news about “creators” and media, whether related to the decline of social media engagement, the issues with “creator” compensation, or the grievances of Hollywood unions and sports associations, it’s clear that the regular playbook doesn’t work for most. Many creative entrepreneurs have the best most expensive lawyers, accountants, advisors; etc. and still end up in shitty bad situations; so you tell me what’s what.

This is an area where an evolved management function can assist creative entrepreneurs, serving as a leader to help develop enterprise strategies within the creative entrepreneur’s ecosystem.

THE HALO EFFECT

Back in the day, in the music business, co-signs were important. How these co-signs went was that a new artist’s affiliation with a superstar artist or executive had the ability to rub off on them and gave them a platform. It’s like high school, “oh you’re friends with the cool kid? you must be cool too”.

That kind of thing.

If you’re someone who always needs data, you may want to investigate the correlation between these artists/executives and their signees; and I could do the work of pulling record sales and providing a “comparative analysis” but..

If you grew up in that era, or worked in the business, then you already know. If not, it is what it is; but, for instance, Dr. Dre co-signed and executive produced Eminem - and that introduction was vital to Eminem’s success. Eminem later co-signed 50 Cent and consumers were later interested in 50 Cent’s ‘G-Unit’ because it was an extension of 50 Cent. Jay Z and Dame Dash’s ‘Roc-a-fella’s’ co-sign helped launch Kanye West. People bought ‘Ciroc’ because of Diddy’s endorsement, just as they bought Ma$e and Danity Kane albums because they were signed to ‘Bad Boy Records’; just as people were interested in Chloe and Halle because they signed to Beyonce’s record label and media company, ‘Parkwood Entertainment’.

So on and so forth.. it’s called the “Halo Effect”.

The halo effect is “the tendency for positive impressions of a person, company, country, brand, or product in one area to positively or negatively influence one's opinion or feelings”; in marketing, it’s used to explain “customer bias toward certain products because of favorable experience with other products made by the same company”. It creates prestige but also serves as a network for you to be introduced to stakeholders and customers in that respective industry … you see a similar thing in the tech and consumer brand sector(s).

Tech accelerators like Y Combinator, startup incubators, and venture studios are, to varying degrees of success, often touted for their ability to identify, develop, resource, and leverage their individual network (or halo) to the benefit of startups; while sharing in the success of these companies - often through equity stakes. I believe a similar model exists for creatives and professionals who can contribute by providing an evolved management function.

Again, this is not a new idea; and I’ve written about it, ad nauseam. In music, for example, you have production companies and independent labels who often identify potential stars, develop them, prove their viability in the market, and “upstream” those artists to a major label; while partaking in the financial success of the artists. In the television and film sector, you have independent production companies who do a similar thing. I believe that this model will only become more important and continue to be refined over time; and as evolved management function companies develop a track record of success, they will be able to leverage their “halos” to the benefit of creative entrepreneurs - irrespective of the arena in which the creative entrepreneurs seek to advance.

In our age, with the rapid advancement of technology, the sky is the limit. I talked a bit about this, in the sports context, here:

A pop culture example of the “halo effect” is the movie ’Love Don’t Cost a Thing’, starring Nick Cannon. The gist of ‘Love Don’t Cost a Thing’ is a nerd gets a popular girl to pretend like they’re dating. As a result, he becomes a cool kid (even though he’s really a nerd). Everyone wants to hang out with him because of his (fake) girlfriend. Even the cool girls now want to be with him. All this eventually goes to his head, and he forgets people don’t actually like him because of who he is; but rather because of who he was associated with, and he ends up going too far and people realize he isn’t actually “cool” and he loses all his “friends”.

That’s the halo effect, in essence (as well as life in general).

Entrepreneurs, businesses, products and services are often looked at as valuable or desirable, regardless of whether they actually are, simply because of who and what they’re associated with; and, often, the average person (or consumer) doesn’t know (or care) better because they want to be associated with, value, or desire whatever (or whoever) is casting the “halo”.

The danger, particularly when it comes to businesses, and for entrepreneurs, is that you depend on the source of the halo rather than the fundamentals of who/what you are. This is only becoming more important in today’s era where information is so readily available; and transparency is often forced or demanded.

For example, it doesn’t matter if your dad is an NBA player or a famous artist, that might get you extra looks from recruiters, brands, or promoters; but you have to ball at the end of the day - he can’t save you once you get out on the court or stage.

Sometimes companies and entrepreneurs forget this. Just because a studio produced a certain movie doesn’t mean people will like or continue to pay for the same thing (e.g. Marvel franchise); just because a company produced a hit product doesn’t mean people will buy the next one (e.g., Amazon Fire phone). So, the onus is on brands, people, and companies alike to do their due diligence, market research; etc. each time, instead of relying solely on whatever goodwill they think they’ve generated.

Goodwill can be fickle, and must be consistently earned.

That’s the danger, but the opportunity is that the halo effect can be used to the benefit of creatives and their partners. 50 Cent is probably one of the best pop culture examples of someone who has navigated this space.

HUSTLER’S AMBITION

My brother recently bought me a record player and vinyl records, including ‘Get Rich or Die Tryin’ by 50 Cent. Besides being one of my favorite albums, I think it’s such a great example of what I’m discussing here.

There’s a lot that can be said about 50 Cent’s career, and you can read more about it in the book he wrote with ‘48 Laws of Power’ author Robert Greene, entitled ‘The 50th Law’; but one of the things I see is his ability to navigate not only the music industry; but Corporate America in general. Much of this is due to his shrewdness and real world experience; but a significant part of it his ability to align himself with stakeholders who could provide a “halo” for him and his brands: whether Dr. Dre, Eminem and Interscope Records, which helped launch a music career that has seen him sell over 30 million records; a corporate partnership with Vitamin Water (where he may have made up to $100 million), or a production partnership with Starz - through which he launched the ‘Power’ series that has consistently set Starz viewership records; and led to a subsequent film and television studio expansion, most recently establishing a studio location in Louisiana.

"Producing a hit is not enough for me"

- 50 Cent

The point is that this is an example of how creative entrepreneurs can navigate and shrewdly leverage partnerships and alliances. Much of this comes down to creative entrepreneurs and their corporate counterparts understanding the value they can bring to the market.

In my opinion, the age-old tension between “creatives” and “suits” is outdated.

We all understand that art is commerce, and art imitates life; but if you don’t understand the lives of the people and cultures from which the art is derived, how can you truly understand the commerce?

I wrote more about it in that article, but the point is both are needed. When we discuss the “halo effect”, developing and leveraging business and market strategy, or crafting partnerships between creative entrepreneurs and corporate partners, we have to understand that there is a balance to the business of art and creativity. All stakeholders have to understand the creative, financial, corporate; as well as cultural strategies.

It reminds me of when I was in law school. I was the ‘Vice President of Entertainment’ of the ‘Sports and Entertainment Law Society’, and I would bring people, from the music, media, and entertainment business, to come and speak. Students were always there and were always excited about the events and the prospect of being a sports and entertainment lawyer; but when I would go “outside”, I rarely saw them doing the work. Today, only a handful are practicing in the sports, media, and entertainment fields. It was one thing to have the “halo” of the ‘Sports and Entertainment Law Society’, it was another to go out and make it happen. You have to go to know.

Or better yet: some things are taught, others have to be caught.

THE GAME IS THE GAME

To recap, creative entrepreneurs in this new era will need a space and networks that can cultivate their unique value proposition in the market. Music, media, and entertainment are not like traditional consumer brands (e.g. Apple and the iPhone). One form of art, most of the time, is not objectively better than another; and it rarely can be successfully mass produced like a widget (e.g., electronic devices). Creative entrepreneurs will need business minded partners and stakeholders who understand this, and have the patience and awareness to help develop a corresponding strategy.

Secondly, creative entrepreneurs will need business partners who can help them navigate and leverage their value proposition by creating strategies and forging alliances, with aligned incentives, which help secure and advance their position in the market.

Thirdly, creative entrepreneurs who break through will need partners and advisors who understand, and/or can assemble a team who understand, how to build and operate commercial enterprises. To that end, if I’ve learned anything in my career, it’s the importance of a team. It’s why I refer to Thrive Sports + Entertainment as a “TEAM Services Company”.

TEAM stands for:

Talent

Enterprise

Agency +

Management

No man is an island; and entrepreneurs venturing on an economic endeavor need a team of specialists. While this article isn’t meant to be a compendium of everything one needs to know, neither do I know everything, another thing I’ve learned and witnessed is that even the smartest and most successful individuals and companies can fail. Bill Gates once said, "success is a lousy teacher. It seduces smart people into thinking they can't lose”.

The point is that creatives, particularly, when venturing out to create ancillary enterprises need to know what they don’t know, who knows it, and how to effectively and profitably assemble a team that can execute. This is tricky, because in the words of the late Charlie Munger, “show me the incentives and I’ll show you the result”.

The media and entertainment businesses, whether overblown or not is debatable, are notorious for vultures and exploitative acts which seeks to extract value from creative entrepreneurs with little eye towards building long-term value; and this goes across the board, for all professions within this sector. As a result, creatives, in my opinion need a point person - akin to a Point Guard or Quarterback whose interests are aligned with theirs. This could be an individual who becomes an equity partner in the creative entrepreneur’s business or it could be any other number of professional arrangements; but the point is that creative entrepreneurs need someone(s) who have their best interests in mind and are invested with aligned incentives.

This is particularly necessary as the business of creative entrepreneurs grow; and more financial opportunities for ancillary ventures presents itself to these creative entrepreneurs. While there are different financing strategies for entrepreneurs, including creatives, one strategy that has been popularized is venture capital. Venture capital, like many other ventures, and even more so, presents risk.

“In his book, VC: An American History, Nicholas discusses the history of VC in the United States. In an interesting comparison, Nicholas focuses on the whaling industry. Nineteenth century whaling can be compared to modern venture capital… Whaling was the archetypical skewed-distribution business, sustained by highly lucrative but low-probability payoff events… The long-tailed distribution of profits held the same allure for funders of whaling voyages as it does for a venture capital industry reliant on extreme returns from a very small subset of investments. Although other industries across history, such as gold exploration and oil wildcatting, have been characterized by long-tail outcomes, no industry gets quite as close as whaling does to matching the organization and distribution of returns associated with the VC sector.”

Basically, venture capital is a risky endeavor; and probably the riskiest. Creative entrepreneurs who are being lured by investment proposals such as venture capital should understand this; particularly those creative entrepreneurs who actually have the opportunity to build or invest in brands. Those creative entrepreneurs have typically already over indexed in their particular field(s). They’ve taken a risk and succeeded where most have failed; and so additional risk should be carefully analyzed - because if you’ve bet the house and won, do you really want to keep betting the house?

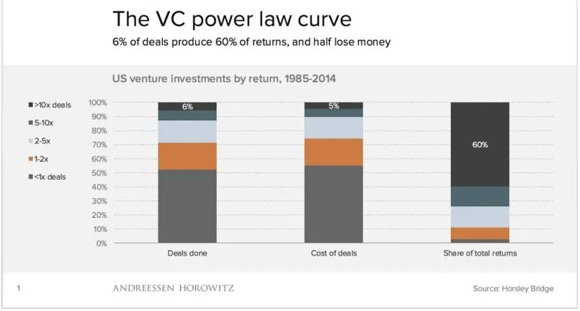

For instance, Jake Chapman, managing director of San Francisco Bay area firm Marque Ventures, was quoted in a Forbes article titled: The Math: A Venture Capitalist Breaks Down Investment In Defense Startups as saying “six percent of venture investments generate 60 percent of all venture returns”.

You can read the article for yourself but the gist is that because VC’s know most of their investments won’t return capital, or profit, and so they depend on a minority of their investment to over index and become the next Facebook, Twitter; etc. VC’s will often target those startups that can return a 50x to 100x ROI. So, often, it’s not about whether the valuation is justified; but it’s about whether one can ultimately exit the company at a 50x to 100x multiple. Sometimes it’s through acquisition, sometimes it’s through IPO; and sometimes the valuation never makes sense for anyone except those who cash out.

“There are a lot of founders trying to raise venture capital who keep hearing ‘no’. The reason isn’t that their business isn’t good,” the reason is that their business is not a potential 50X or 100X. They don’t understand why their business has to be a 50X when most venture funds, especially the large ones, are only returning 2X-3X to their LPs. A 5X investment really doesn’t move the needle for a fund when more than half of its investments are going to go to zero.”

- Jake Chapman

CAPITAL CALLS

The reason all of this is important is because financially successful creative entrepreneurs often get presented with opportunities, whether to invest, or to receive investment; in addition to coinciding term sheets and contracts, and they often have no idea of what it all means - and even if they do, and their advisors have counseled them; it still often doesn’t make sense for them in their unique position.

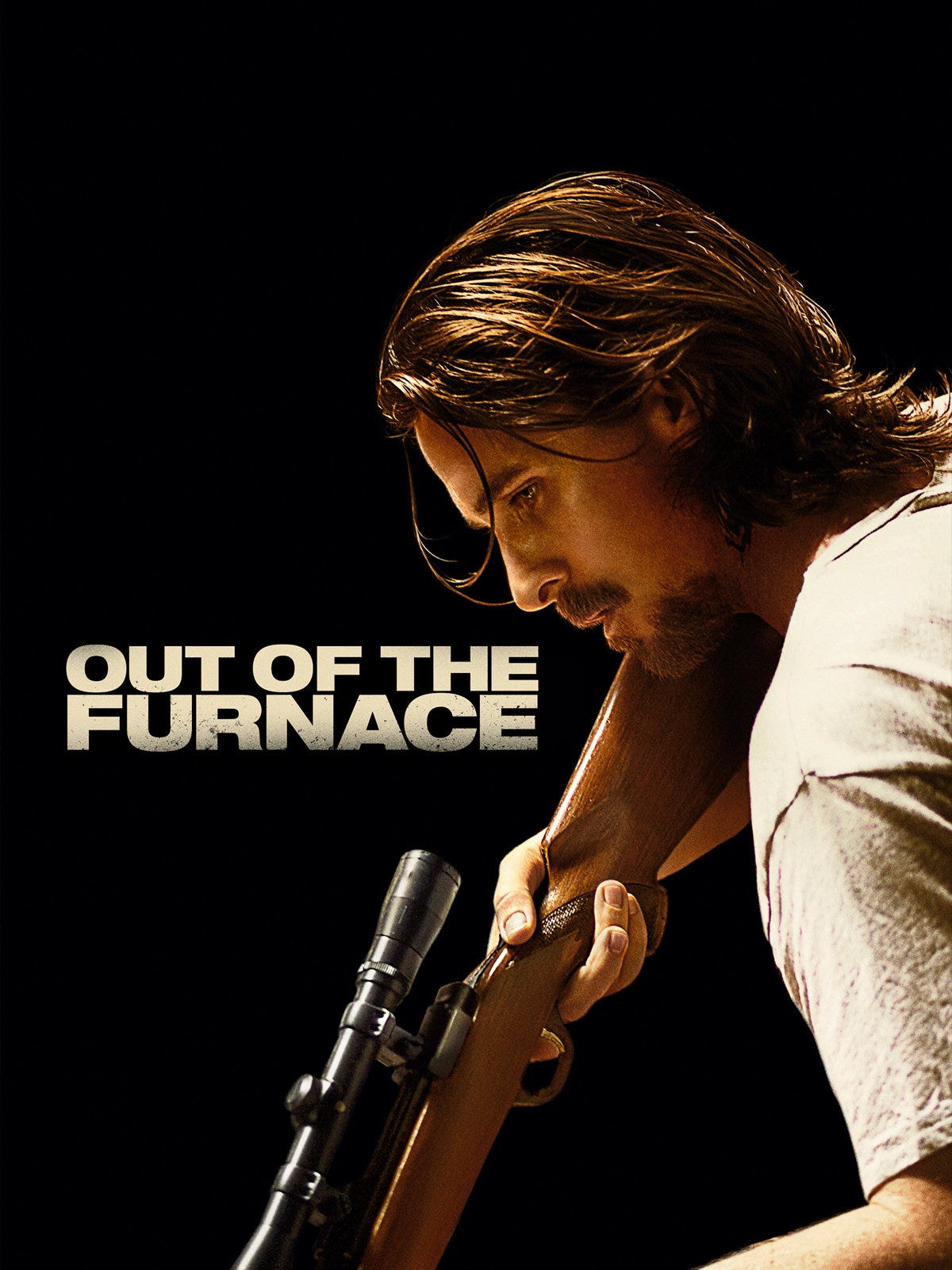

Or to quote one of my favorite movies, ‘High Flying Bird’, “there’s a game on top of the game”.

Or Mark Twain, “it ain’t what you don’t know that gets you in trouble, it’s what you know for sure that just ain’t so”.

This is one of the reasons I’m taking an executive course at Columbia Business School, so I can better advise creatives in their business and legal affairs. The goal is to build a house for Creative Entrepreneurs like Richie Rich.. both Richies. From working with creative entrepreneurs, I also realize that much of the value goes to executives rather than the creative entrepreneurs themselves.

This is something I’m going to change.

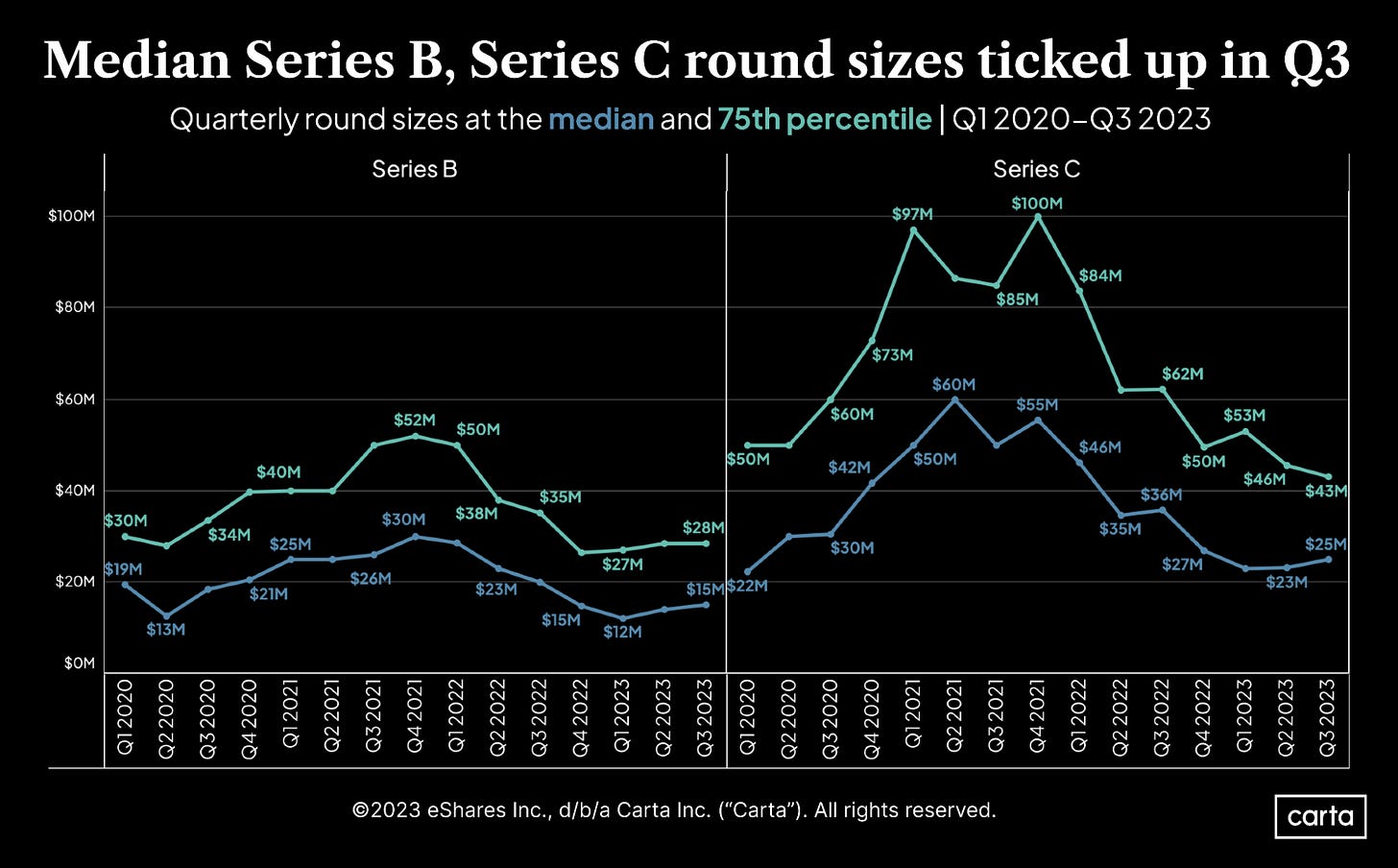

Here’s an example of why this is important: one way people value companies is by analyzing the market and shooting for a valuation in line with current valuations at their respective stage. Basically, they may look at what companies at their stage are raising and ask for that. Carta, a technology company that specializes in capitalization table management and valuation software, reported that the median Seed stage valuation in Q3 of 2023 was $3m; whereas the median Series B and C valuations were $15m and $23m, respectively.

So if you were a creative entrepreneur, or even a startup founder, raising a Seed round today, you would want to shoot for at least ~$3m; or if Series B then ~ $15m, so on and so forth. But benchmarking simply gives an overview of the valuations, right? It says nothing about the actual revenue, or revenue potential, of those companies; and venture capital is notoriously speculative so two companies could be raising in the same round, and have different revenues and receive the same funding amounts; or have the same revenues, yet receive different funding amounts.

Yes, you have to take the “total addressable market” into consideration; but, still, it’s kinda weird.

It’s great (sometimes) if you’re an entrepreneur, but can be arbitrary if you’re an investor. Carta’s Data Report even points to the inadequacy of looking at valuations, alone, as an analysis of the health of the market as a whole - “at the same time valuations were trending up in Q3, the number of deals taking place was still trending down”.

To punctuate this point, another Carta report, ‘Why VC’s aren’t dwelling on the rise in down rounds’, states “as recently as Q1 2022, just 5.2% of new fundings on Carta’s report were down rounds. . in Q3 2023, that figure was 18.5%, continuing a nine-month stretch in which nearly one out of every five rounds raised by startups resulted in a decreased valuation”.

Now, while much of that may be a correction; the point remains, as a creative entrepreneur or investor, you can’t simply look at “average valuations” in order to determine the state of viable companies in the market. But when you get pitched on an investment, as an actor, athlete, influencer, or musician, how do you know what’s what?

That’s my point. In my experience, creative entrepreneurs need more than traditional advisers who do things the way they’ve always been done.

One of the reasons I shut down my music law practice several years ago and became an in-house attorney for tech companies is that I saw the traditional structure was broken for many creatives.

For example, as a music lawyer, I realized that it wasn’t enough to negotiate a risk adjusted deal if the artist, writer, or producer didn't have the proper business strategy in place; as well as the proper team. Additionally, it was difficult for me, as a lawyer, to help them in ways that didn’t disadvantage me (lawyers have to get paid too). What many creative entrepreneurs need are stakeholders, with vested interests and aligned incentives, who understand their particular value-add and can help them navigate the terrain.

Another example is Taraji P. Henson who fired her team for not capitalizing on her success after her breakout role in ‘Empire’. In all fairness, the business of creatives is difficult because it usually comes down to volume vs. value. Will you represent a large amount of creatives or a few creatives and/or properties that over-index; and then the question, if your answer is both, is how do you profitably scale?

Basically, many companies represent a lot of creatives and find that providing quality service to each individual, and leveraging their unique positions and success in a bespoke manner becomes difficult.

As I wrote in this article, you have to understand your thing; and continually develop it:

I believe this is another area where we’ll continue to see innovation; particularly in the structure of representation between creatives and business partners and the management functions. It’s not merely about going “wide”, it’s also about going deep and understanding the unique value-add of the specific creative entrepreneur and their respective cultural value-add.

To that point, and as I hope I’ve adequately laid out, it’s not enough to have a “hit single”, “breakthrough role”, “viral video”, or even to be drafted by a professional sports team. Creative entrepreneurs will need to align themselves with invested stakeholders and align incentives in order to ensure continued success, and (potentially) create profitable ancillary ventures based on their unique and individual positioning.

NEW PHONE, WHO DIS?

To close this out, one thing I’ve learned in life is that the foundation is the most important part of anything you build. It doesn’t matter how high the building is if the foundation is faulty.

Like many things, how you start is how you end.

I once had a relationship with a young lady where things started pretty quickly, and got serious fast. Things were great until they weren’t.. then she started showing up at my apartment unannounced (in the middle of the night). To be clear, it wasn’t all on her. I had my issues as well and did my fair share of wrong; but, needless to say, what took off fast - crashed pretty quickly. We (I) didn’t take the time to vet one another and truly understand whether we were compatible and should embark on a serious endeavor; and, as a result, we couldn’t finish.

Diligence.

“For which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it? Otherwise, when he has laid a foundation and is not able to finish, all who see it begin to mock him, saying, ‘This man began to build and was not able to finish.’ Or what king, going out to encounter another king in war, will not sit down first and deliberate whether he is able with ten thousand to meet him who comes against him with twenty thousand? And if not, while the other is yet a great way off, he sends a delegation and asks for terms of peace.”

- Jesus Christ (Luke 14:28-32)

That applies to many areas in life. Due diligence and preparation are important. This is why, particularly, in media and entertainment, creative entrepreneurs need to understand that this is about commerce just as much as it is art. If you don’t understand that, or delegate the business operations to those who do and can execute, you’re in for a rude awakening.

Most creatives, and entrepreneurs in general, fail - not because of a lack of talent; but because of a lack of diligence, preparation, and team building; etc. I’ve been through it, personally, with companies I’ve started and tried to start.

The truth is that talent is “cheaper than table salt”. There’s no shortage of intelligence (despite what some may think) or natural talent in the world; but it’s the extra, often extra effort, which makes us extraordinary.

Luck = Preparation + Opportunity.

“I have observed something else under the sun. The fastest runner doesn’t always win the race, and the strongest warrior doesn’t always win the battle. The wise sometimes go hungry, and the skillful are not necessarily wealthy. And those who are intelligent don’t always lead successful lives. It is all decided by time and chance (opportunity), by being in the right place at the right time.”

- King Solomon (Ecclesiastes 9:11)

That said, I believe that we’re going to continue to see greater developments in this new era of partnerships between creative entrepreneurs, traditional business professionals, management functions, technologists, and corporate stakeholders which build on old themes; yet, redefine the business of music, media, sports, and entertainment in new and exciting ways. I don’t think it’s as easy as throwing out random numbers and statistics; we’ve clearly seen that doesn’t work. I believe a significant part of this is will be qualitative and experiential.. with a little luck mixed in.

In any case, I hope to see you there.

✌🏾🇳🇬

![PAPER VIEW: ATLANTA CHRONICLES: [S1, EP 2]](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9db921d7-68df-48b2-a2f8-6bdbfd574831_1280x720.jpeg)