(W)RAP TECHNOLOGY (PT. 1)

Rethinking Ownership at the Intersection of Sports, Media, Entertainment and Technology

In this article, I’m talking about how artists, creators, and athletes can position themselves for greater levels of ownership and influence in business, including technology companies.

Let’s get started.

While there are nuances and differences between businesses in varying fields, such as product, specialization, and regulation, there are many similarities; such as financing, operations, and commercial transactions.

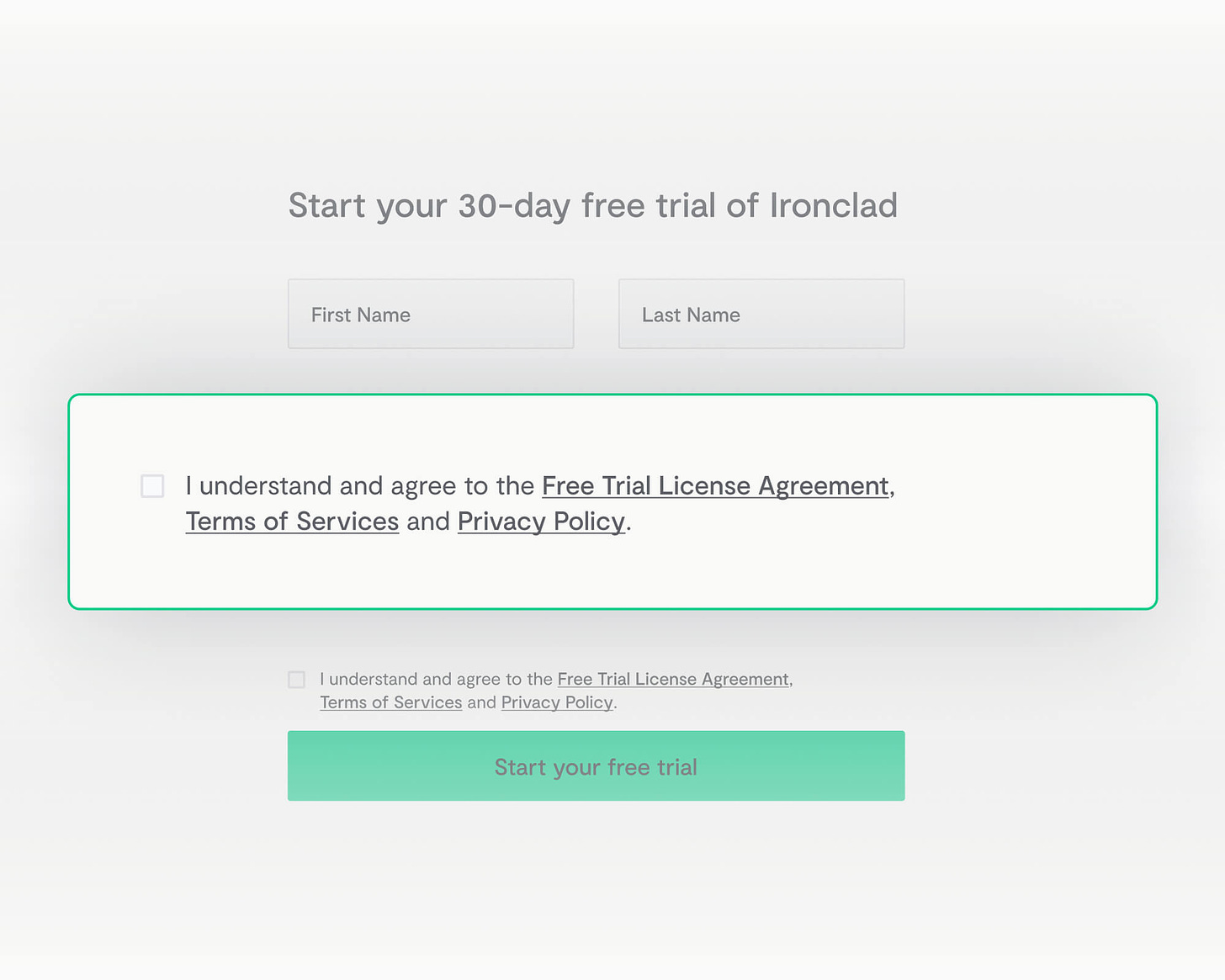

For example, like any other business, technology, and software companies enter into commercial agreements between themselves and their customers. One common example that you’ve probably seen is a clickwrap agreement.

A clickwrap agreement is an agreement that requires a consumer to “click-through” in order to accept the terms and policies governing the use of a company’s product (or software) before being able to use the agreement.

It usually looks like this:

You see this type of agreement often in digital or technology products and services. The terms of these agreements are just as important for the company as they are for the user - because they govern the rights, obligations, and remedies of each party.

For example, there’s a distinction between a SaaS (software as a service) business model and a Software License business model. There are many differences between the two: but an example is that a software license typically grants you a license and right to use a physical, and sometimes downloaded copy of a company’s software. A great example of this is the Microsoft Office CD-ROMS we used to buy. You received a license to use that software for as long as you wanted, but were required to maintain it.

Now, tech and software companies have largely converted to a SaaS business model where they grant you access to their software, which they host, and in return maintain the service - including the cybersecurity aspects. An example of this is Netflix or Dropbox. In a SaaS business model, customers aren’t receiving a software license because that would potentially grant them the right to use the company’s main software (and code). Instead, customers receive the right to access the software service - usually for a monthly subscription price.

The benefit to software companies who utilize the SaaS model is that they can generate recurring revenue (e.g., $9.99 a month x millions of consumers), which can boost the lifetime revenue of customers; in addition to boosting the company’s corporate valuation (and subsequent profits for shareholders and investors).

In the same way, artists, creators, athletes, and other “influencers” need to analyze their business model, determine the most profitable way to operate; and use that understanding to inform their various business dealings and agreements.

UNTAPPED MARKETS

An example of this is the music business.

Music has always been delivered via technological products: whether the Graphophone, Gramophone, 8-Track, Audio Cassette, Walkman, CD, MP3 player, or iPhone. This shows that the music business has been inextricably tied to technology and product; but artists and music companies have, often, not taken full advantage of this.

Much has been written about the impact of peer-to-peer file-sharing, and software companies like Limewire and Napster on the recorded music industry, so I won’t regurgitate. We all know how that technology decimated music business revenues, how the record labels fought against those companies, and how new software like iTunes and music streaming came to be the standard.

The thing that often gets missed, though, is that it wasn’t really those companies and their software that “disrupted” the music business; it was consumer behavior.

Fans were growing tired of having to pay up to $20 for CDs when they really only cared about 2 or 3 songs. I vividly remember buying CDs only because of the hit single that I heard on the radio, or saw on ‘TRL’, ‘106th and Park’, or ‘Rap City Tha Basement’; and being sorely disappointed when I listened to the album. I even threw away one or two CDs because of that. So the reality is that those peer-to-peer file-sharing software companies were a threat largely because they acquired a market insight, built a product based on that insight, and organized a company around the product.

That’s the play.

Unfortunately, today, you don’t see many artists, creators, athletes, or “influencers” take the lead in the business sectors that they (should) know the best. Even when you read the press releases of business news in these fields, or attend conferences, you often don’t see artist opinions represented there.

Whether we’re talking about the digital music service providers that dominate recorded music revenue, digital ticketing platforms that dominate the live music space, or the social media companies on which many artists stake their futures; these entities are largely owned and controlled by people who aren’t the practioners in those fields.

The executives run the business.. and the artists (or the music) are the business.

To be balanced, that makes sense to a degree. Starting, building, and operating a business requires an executive skillset - one that many artists, athletes, creators, and “influencers” don’t have; but, in my opinion, can develop - if willing.

So then the challenge for artists and creators, of all kinds, is to step out of the box of simply being a product or a resource; and into the space of someone who dictates and controls the product and resource that is their music, their athletic skill, or their media influence. It's easier said than done, but that’s the opportunity, and it’s an opportunity that I think is largely untapped.

It’s why Beats by Dre was founded by Dr. Dre and Jimmy Iovine and eventually sold to Apple for $3B. Like all businesses, Beats by Dre was built on culture and used a particular culture - in this case, hip hop and black culture (two separate things) - to market the company. Jimmy Iovine himself has said that “African-American culture is one of the most undervalued assets that America has.”

In my view, this lack of value doesn’t just extend to African-American culture, but culture of all kinds - and has ramifications on business, as I mentioned in this article. If you don’t understand the culture you want to market to, then you’re success will be short-lived or minimal at best.

It’s why it seems like we see creator-economy companies folding every other week.

The way I see it, though, there’s a largely untapped opportunity for artists, creators, athletes, and influencers to leverage their influence in the “creator economy” by building companies that compete with preexisting institutions. This doesn’t just have to be in technology; it’s about building brands and businesses, period; but, for this article, let’s stick with tech.

SEND THE STEMS

One recent example of someone who has consistently sought to tap this opportunity is Kanye; most relevantly, with the Stem Player, which he sold for $200 - and which made $2 million the same day - more money than would have been made had it been streamed. An interesting comment made by Kanye in that article was that ‘Donda 2’ would have had to be streamed 500 million times in one day in order for him to make that same amount of money.

For context, the biggest first-day streaming opening belongs to Taylor Swift’s ‘Midnights,’ which generated 184 million first-day streams.

But after Kanye’s recent controversy, it came out that the Stem Player was actually owned by a company called Kano Computing, Ltd.; and that the Stem Player had simply been developed in “collaboration” with Kanye. It was also publicized that Kanye had offered to buy Kano Computing, Ltd. for $80 million or was open to a joint venture with Kano and outside venture capital funding to build his own tech company.

Of course, none of this materialized; but let’s see what happens next.

All controversy aside, the reasoning made sense. You make more money on a $200 device than from a $0.003 – $0.005 per stream; particularly when you can leverage super fandom. An extension of this idea could even have been to sell the device plus a monthly subscription to a corresponding (or separate) app that provided fans with exclusive content or updates.

Remember, recurring income is key.

MARKET COMPETITION

So why don’t we see things like this happen more often?

For starters, many artists don’t do the work to learn, and aren’t exposed to the information and possibilities; also, it’s extremely difficult to even get to the point where you can leverage “fandom.”

But also, like any other business, if market participants aren’t incentivized to invest in an endeavor, then they probably won’t. Late Harvard University Professor, Clayton Christensen, called it the “Innovator’s Dilemma”. Essentially, companies become established in a particular business line; they scale, hire people, and have now created dependencies on a particular mode of operation and product or service line.

For example, if you manufactured rotary phones, it would not immediately be in your seeming best interest to develop wireless phones (particularly if you didn’t have an insight that people would want wireless phones) because that would cannibalize your business; but here’s the rub, eventually wireless phones disrupted the landline business, and it would have been a smart move to get into that business early.

So how does one do it?

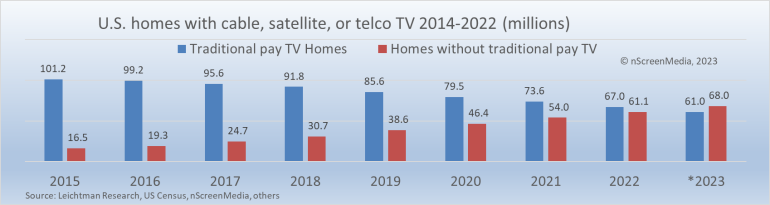

Well, if we look at the media sector, traditional cable companies are doing this by investing in OTT (over-the-top) platforms while maintaining their cable business. For example, The Walt Disney Company owns ABC and ESPN. You used to only be able to access those through a traditional cable bundle, but they’ve also developed OTT platforms like ESPN + and have included ABC in OTT platforms like Hulu where you can access the same content for a monthly subscription fee. Disney has also created Disney + with a select menu of programming which is unavailable on standard cable.

This way they keep their foot in two streams, providing for the new wave of innovation while not completely cannibalizing their traditional cable business. Media companies, like Disney, are seeking to manage their current business while looking ahead.

Here’s an example of how the cable business has changed in America, over the years:

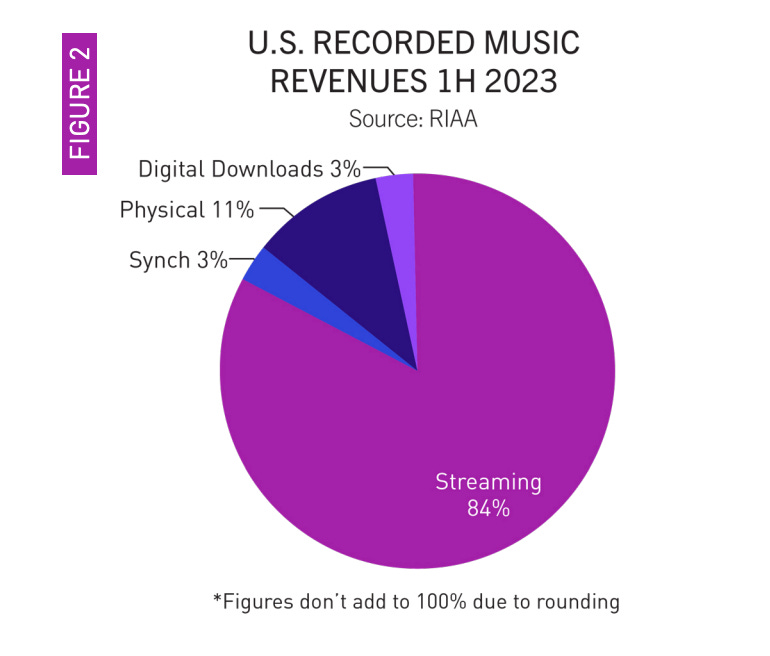

So when we look at the traditional recording business, for example, how is money made now? According to statistics, “the music industry brought in $8.4 billion in the first half of the year, with streaming making up 84 percent of the pie”. Clearly, streaming is the new money maker for the music business; but, of course, it’s important to remember that these statistics are specific to recorded music revenue; and don’t include touring or merchandise - areas where most artists will make the bulk of their money.

The reason I bring this up is that it’s important, in any business, to understand the driver(s) of revenue because that tells you where companies and market participants are incentivized to focus now. It’s why the most talented artists (which can be a subjective measure) don’t often get signed by the majors; but rather those with streams and streaming indicators (such as trending statistics on social media). The major labels aren’t immediately incentivized to focus on other areas; they’re incentivized to focus on their core business.

So when we speak about developing artist, creator, athlete, or “influencer” businesses, we must analyze it through that framework - understanding how businesses make decisions. Once you understand that, you understand how you should construct your business affairs and develop your business strategy moving forward.

DIVERSE WAYS

In my view, there’s a significant opportunity to create diversity in the modern business landscape. When I speak about diversity, people often talk about race or gender, which is a type of diversity; but I also think about neurodiversity which is essentially diversity of thought or mental outlook. A company can hire a black person but expect them to think like white people; you could hire a woman and expect her to think like a man - and vice versa.

Is that true diversity?

My take - true diversity is bringing different ways of thinking, backgrounds, and experiences to the corporate table to fulfill a profitable agenda.

So when I talk about this topic, I’m talking about how making artists, creators, athletes, and influencers stakeholders in corporate endeavors can create new and innovative businesses. That said, there’s often a knowledge and awareness gap that prevents this from happening. For example, many artists, creators, and athletes know “tech” is a big thing; but they don’t know much about it, nor have they been introduced to that world - and so it’s like a different language.

I can relate. I never thought about a tech career or was aware of what tech and software companies do or how they’re built. I stumbled into it and only began my in-house legal career in 2019; and for me, it’s been a steep learning curve; and I’m still learning.

aNd i’M a LaWyEr, so imagine the average artist, creator, influencer, or athlete.

But here’s the thing, the more you learn about tech, Silicon Valley, the startup world, and business in general, the more opportunities you see.

BLACK FACTS

All that said, racial and gender diversity are real things. Just like in other sectors, such as law, where ~ 4.5% percent of lawyers in America are black, you see a similar thing in the corporate startup world.

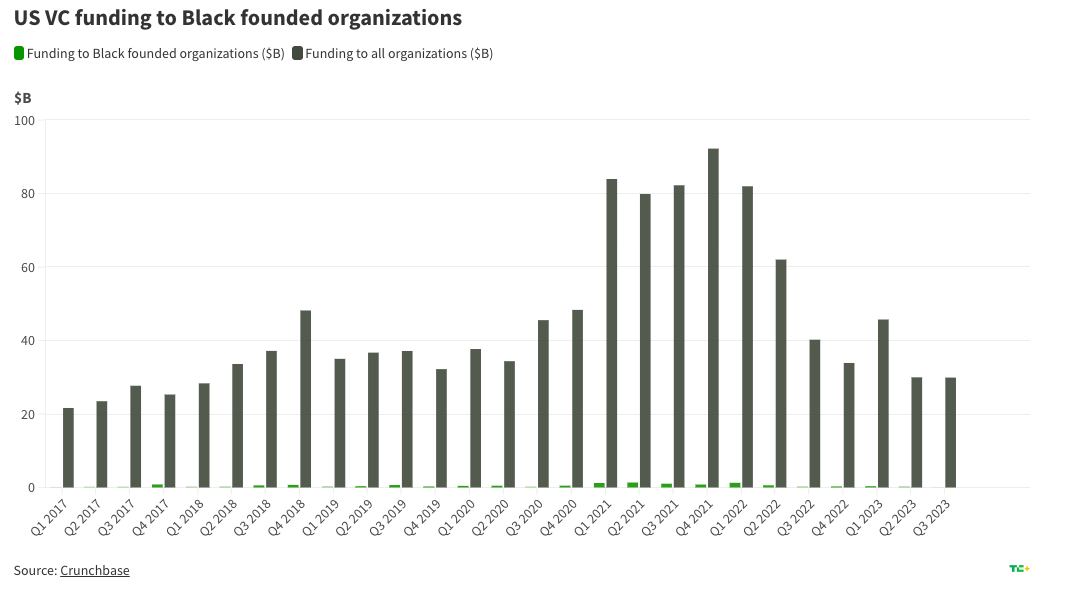

In Q3 of 2023, “black founders raised 0.13% of all capital allocated to U.S. startups in (about $39.7 million out of $29.9 billion)”.

Crazy, right? Welcome to the party.

Funny story. I was once talking to a female VC, who happens to be white, and our conversation about breaking into venture capital went something like this:

Female VC: I’ve successfully played the woman card; you should consider doing the same... I hope that wasn’t offensive.

Me: Nah, it wasn’t offensive. I’ve thought about it, but a lot of these Silicon Valley guys don’t react too well when you bring up race.

Female VC: Yeah, that’s smart; you’re probably right.

Me: Who knows, though... maybe I’ll think about it.

Female VC: Well, just make sure you think about it, I’m not so sure…

Me:

Lol.

On a serious note, people say the funding disparity is for varying reasons; some say unconscious or conscious bias, “pattern matching,” a pipeline problem, or that founders of color and women don’t start businesses that work for most VC models. The latter is a whole other point that I’ll cover later, but what’s my point?

Irrespective of why this is a problem, it’s a problem, but that also means there’s an opportunity; and the opportunity I see is that when it comes to artists, athletes, and other high-net-worth or high-profile individuals, this isn’t as much of a problem. You already have the fan base, attention, network, and lackeys who ride your.. coattails. All you need is the correct information.. and protection.

Essentially, you’ve gotten to where most business owners are trying to get; you just need to understand how to leverage your position.

ROUGH MOVES

In ‘The Godfather,’ Michael Corleone tells Tom Hagen, the family lawyer, “You're not a wartime consigliere, Tom; things may get rough with the move we're trying!”

When it comes to business, things have to be tight, and people have to be on the same page. Your team, particularly your closest advisors, have to know where you’re going and what it takes and be willing to get there. There’s a passage in the book of Psalms that says, “Your people shall be willing on your day of battle.”

That’s what we need.

People who are willing.

Some people only show up when it’s time to party, but what you need, especially when you’re the emergent, is people willing to go through the fire because 9/10 times, you won’t have the resources, network, nor influence that the establishment in that sector will have - so you have to make up for it in other ways; namely: grit, perseverance, vision, and resourcefulness.

CONSIGLIERE COUNSEL

So, in conclusion, when looking to make this move, here are a few considerations to keep in mind:

Go To Market Strategy - What is your concept for capitalizing on your influence? There are different ways to do this, and many examples include Jay Z and Tidal, Kim Kardashian, Skims, her previously launched app, and her media brand, Kevin Hart and the Laugh Out Loud Network, Nick Cannon and his NCredible empire, and Kanye, Stem Player, and the Yeezy Brand. What’s important is understanding what makes sense for you organically.

Many people think just because they’re famous, people will flock to anything they do. That’s not the case, and it is lazy thinking. You have to analyze multiple things: including your personal taste, influence, and vision, but also your fan base: what kind of fans you have, what percentage of them are super fans - meaning they’re willing to pay a premium price for access to you and your brand - and your brand promise; and then begin crafting a strategy for an ancillary market opportunity.

Intellectual Property - You must protect and register all intellectual property (IP) associated with your brand, whether this is copyrights for your creative works, trademarks associated with service and product lines, or patents associated with tech and engineered goods. Intellectual Property is one of the ways you establish brand identity and value in the market; proper registration also enables you to enforce your rights and prevent others from imitating your goods and services. When it comes to certain forms of IP, such as copyrights, you cannot file an infringement lawsuit without registration.

Commercial Agreements - As mentioned in this article, commercial agreements are a staple of all businesses. Whether we’re talking about music, media, entertainment, or sports, each sector utilizes commercial agreements. If we’re talking about developing a software product, you will also need commercial agreements such as developer agreements. I wrote a bit about developer agreements here. The concept behind this is to create a specific statement of work that outlines what the developers are creating for you and establishes your ownership over any work product - including an assignment of any underlying IP created through the development agreement. data processing agreements, master service agreements, and NDAs are other general commercial agreements that you would likely use in developing software or a software company.

Corporate Structure - One of the key goals of any business is scale, but ultimately, your end game will determine the type of corporate structure you utilize. For example, if you believe that you ultimately want venture or private equity investment in your business, then you may want to incorporate your company as a corporation since that’s the preferred structure of investors. If the goal is for the company to serve as a personal holding or service company for yourself and your career - such as a company that owns and licenses your trademarks and copyright (e.g. for endorsement and synch licensing purposes), then an LLC would be suitable. In any case, you will want to consult with an attorney and/or tax advisor to understand the best strategy for your specific case.

Executive Team - The previous items are considerations that lawyers can assist you with as you grow, but it’s not just essential to have legal in place; you also need to grow. Most lawyers aren’t software developers, sales executives, or operation specialists; depending on your team's output and the level of growth needed, those are the kinds of individuals you’ll need. You’ll need someone to manage your company's operations and scale it through effective hiring of personnel unique to your company’s needs. You don’t need to copy what other people are doing, but you do need to understand what you want to accomplish, the limitations of your current team, and the right people to add.

But a good thing about this modern era is that platforms like LinkedIn and social media expose you to accomplished specialists and executives in various fields, many of whom have set up their own shops or work as consultants. The sky is really the limit if you know what you don’t know and know how to find who does.

The exciting thing to me is that if you’re an artist, creator, or athlete who already has a primary business operations line, you could hire someone to function in dual roles.

For example, someone who is your personal marketing manager/agent could also serve as head of marketing for your new app.

Let’s take Athlete X, who has a prominent profile (going back to my article about the 3 P’s of Marketability). The marketing manager/agent could be running your personal brand marketing under Athlete X LLC, where they’re paid a salary or commission, but could also be Chief Marketing Officer, or a co-founder, in your Athlete X App, Inc., where they would receive equity in exchange for helping to build the app.

Another scenario: Athlete X LLC could hire developers to create a software owned by Athlete X LLC that serves a particular function for the athlete alone - and once they’ve proven product market fit, they could spin (or sell) the app off into a separate company and hire people to build the app separately. This was, essentially, the playbook of Major League Baseball’s BAMTech.. but that’s another story.

Until next time.