WHEN JACK GETS PAID, DO YOU? (TIDAL WAVE)

An Analysis of Block Inc's Shareholder Lawsuit

If you’re getting this email, you were subscribed to my previous publication, ' Spin the Block.’ I’ve decided to discontinue it and narrow the scope of my professional writing.

I view ‘Spin the Block’ as a moment in time, an art piece of sorts, and I’ll do something with some of those writings in the future.

Speaking of blocks, that brings me to the focus of today’s article - Block Inc’s shareholder lawsuit over the 2021 acquisition of majority ownership in music streaming platform, TIDAL.

WHAT HAPPENED?

In 2021, Block Inc., led by Jack Dorsey, acquired a majority share interest in TIDAL for around $300 million (depending on the article you read, and the financial statement you analyze). This acquisition was widely heralded in social media, news publications, and pop culture circles as a savvy business move, indicative of Jay Z’s business prowess. It was also a signal, for those in the know, to Jay-Z’s 2020 lyrics on the song ‘Entrepreneur’ where he rapped, “Black Twitter, what’s that? When Jack gets paid, do you?”

Well, as Yahoo Finance reported,

“Many people assume that Twitter was the reason for Jack Dorsey’s impressive fortune, but that actually isn’t the case. When Elon Musk acquired Twitter in October 2022 for $44 billion, Dorsey held a modest 2% ownership of the company’s outstanding equity, equivalent to approximately 18 million shares. Dorsey's pre-tax earnings from the Twitter sale amounted to $978 million.

The true source of Dorsey's wealth lies in his involvement with Block Inc., a renowned payments company originally known as Square. As one of the co-founders, Dorsey's ownership of 43 million shares in Block has proven immensely lucrative. With the current share price standing at $64, Dorsey's stake is estimated to be valued at around $2.75 billion”

When Jack got paid, Jay got paid.. get it now?

Jack Dorsey’s pay-day, and relationship with Jay Z, got Jay Z paid via the 2021 acquisition of TIDAL by Block. However, this transaction upset some of Block’s shareholders, primarily a pension fund shareholder, in Block, which alleged in a lawsuit that “Block founder and CEO Jack Dorsey and the company’s board of directors breached their fiduciary duties in agreeing to pay roughly $300 million to take control of TIDAL as it was failing financially and the target of an ongoing criminal investigation”.

In their view, the acquisition was a poor business decision, and the shareholders sought legal remedies against the defendants. In case you guessed, have read about this case before, or are tired of reading this, the shareholders lost the case. But if you want a deeper dive, here’s how it happened.

In writing this, I read the court case for this proceeding and even dusted off an old law school book. Let’s get into it.

COURT OPINION

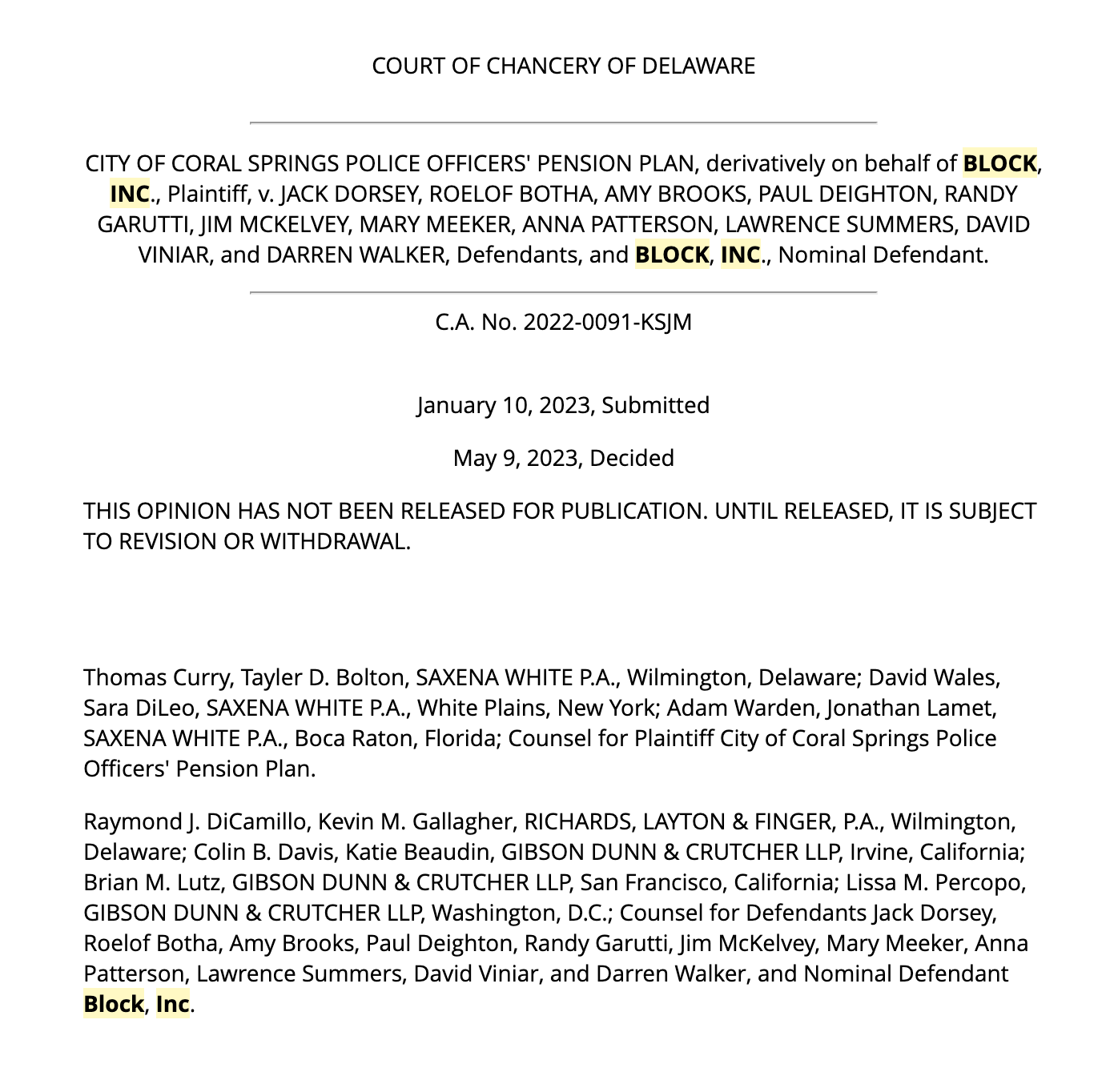

Source materials for references and direct quotes to this case can be found at Coral Springs Police Officers' Pension Plan ex rel. Block, Inc. v. Dorsey, C.A. No. 2022-0091-KSJM, 2023 BL 157458, at *5 (Del. Ch. May 9, 2023)

This case was brought specifically by the City of Coral Springs Police Officers’ Pension against Block Inc., Jack Dorsey, and other Block Inc. officers.

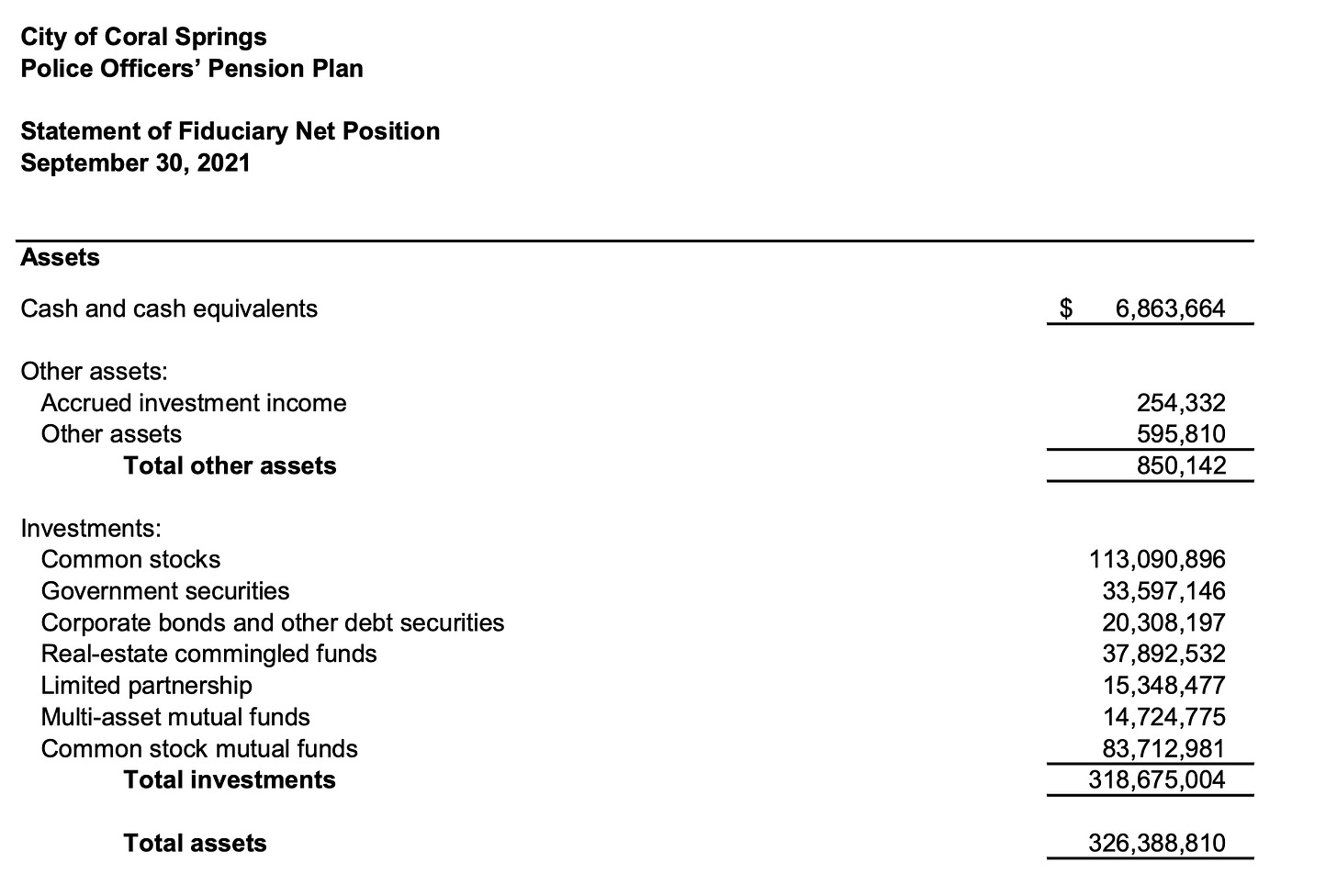

As of their latest disclosure, the pension fund has assets over $326b.

..that’s Billion, with a big b.

These assets are divided and invested in varying investment vehicles, including government stocks, corporate bonds, mutual funds, and other investments, including private equity investments in companies such as Block.

According to a 2023 article by Bloomberg, “Assets in the private market have grown exponentially in the last 20 years, especially in North America, and now amount to nearly $12 trillion. The number of companies backed by private equity more than doubled between 2006 and 2020, while the number of public companies shrank.” Additionally, according to “Columbia Business School Ph.D. candidate Vrinda Mittal in a recent paper. Public pensions make up 31.3% of all investors to private equity funds and contribute 67% of their capital”.

This has all sorts of ramifications on the country and the welfare of citizens and professionals who depend on these funds and investments, but that’s outside the scope of this article.

The net of all this is that it’s important to pension funds, and their management teams, that their investments, are relatively safe and their capital returned. It also sets the stage for conflict when that isn’t the case; and provides context as to why the City of Coral Springs Police Officers’ Pension may have brought this action against Block, Inc.

So what did the court say?

Legalese

To start, the plaintiffs allege that Block, Inc. never had plans to acquire TIDAL, and that the idea only came to Jack Dorsey (Founder and CEO) when he was “summering” with Shawn Carter (Jay Z) in the Hamptons. From there, Jack called Block’s board of directors and proposed that Block acquire TIDAL.

This was problematic, to the plaintiffs, for a few reasons (in their view):

TIDAL had financial issues,

TIDAL was facing an ongoing criminal investigation

Shawn Carter (Jay Z) had personally loaned TIDAL $50 million to keep it afloat; and

Jack Dorsey was, reportedly, the only management member in favor of the acquisition

As a brief background, Jay Z acquired a streaming company, then known as ‘Aspiro’, in 2015, re-branded it as ‘TIDAL’ and launched with a famous artist-led press conference; but, depending on who you ask, TIDAL had struggled over the years.

This is a good time to say that I’m a TIDAL subscriber.

That said, according to court filings, there seemed to be some disagreement within Block about the merits of the deal. This disagreement revolved around a few additional factors:

By mid-2020, TIDAL had 2.1m paying subscribers compared to Spotify’s 138m, Apple’s 60m, and Amazon Music’s 55m.

Between 2015 and 2020, TIDAL had gone through five different CEOs; and, among other things, had incurred unpaid liabilities of around $127 million to labels for streaming fees.

During the deal evaluation process, Block set up a Transaction Committee, in which, Block’s management reportedly mentioned that it would be difficult for TIDAL to grow its subscription numbers and advance its position in a sector dominated by Spotify, Apple, and Amazon Music. Additionally, TIDAL had generated “negative EBITDA (earnings before interest, tax, depreciation, and amortization), of $39m”.

The management team was essentially arguing, or pointing out, that the deal didn’t make sense to them; and that it would be difficult for TIDAL to advance its position in the market due to the dominance of Spotify, Apple, and Amazon Music.

The shareholders pointed all of this out in their claim challenging the acquisition; however, this ruling ultimately came down to the Court’s opinion that the Block’s Board of Directors acted in good faith when approving the acquisition; or at least, didn’t act in bad faith, or didn’t not act in good faith.. idk it gets weird, and there’s more to it; but here’s the point:

The Business Judgment Rule

In moving to dismiss Block’s claim, the Court pointed to the Business Judgment Rule, which, as the Court artfully summarized, says, “a board comprised of a majority of disinterested and independent directors is free to make a terrible business decision without any meaningful threat of liability, so long as the directors approve the action in good faith.”

In discussing this rule, it’s important to zoom out and understand a few things:

In Corporate Law, particularly in Delaware, the board of directors, and to a lesser degree, directors of the business, are the managers of the business; rather than the shareholders.

This means that those Directors have, what’s known as, a fiduciary duty to act in the best interest of the company.

Where these Directors fail to act in the company's best interest; and/or otherwise act in bad faith, shareholders may bring a lawsuit under certain circumstances.

In this case, the Court didn’t think the board of directors acted in bad faith. Bad faith would have required showing that the board had actual or constructive knowledge that approving the acquisition was legally improper. It wasn’t enough for the plaintiffs, to simply say, “This was a bad deal!”

WHEN JACK GETS PAID, DO YOU?

Alright, those are the legal takeaways from this case; but what are some operational and practical lessons we can take away?

You don't get what you deserve, you get what you negotiate

According to the court filings, Block’s management team had initially set an “expected purchase price of $550 - $750 million”. According to court documents, Jack had then submitted a “non-binding letter of intent for the company to acquire Tidal for $554.8m”; this appears to have also been partly informed by TIDAL management’s financial forecasts and representations that it was in “discussions with an undisclosed third party for a loan that valued TIDAL at $500 - $600m”. In other words, the presence of another bidding company drove up the price of TIDAL.

However, because of financial concerns, the price was eventually reduced and closed at $306m for 87.5% of TIDAL.

“Although, in its 10-Q filed on November 4, 2021, Block disclosed that, after adjustments, it ultimately paid $237.3 million for an ownership interest of 86.23%. For accounting purposes, Block characterized $198 million of the purchase price as ‘Goodwill’.”

All that said, even with the concerns of Block management, and its shareholders, TIDAL was able to negotiate a price it felt it could accept, even if others didn’t think it deserved that price. In the words of Ari Emmanuel, “Fair is where we end up.”

Relationships Matter

I’m someone who firmly believes in self-sufficiency and self-reliance, but it’s incontestable that partnership is powerful and a force multiplier.

As the court documents lay out, Jay and Jack had a pre-existing relationship, one where, according to court documents, they “jointly issued grants for COVID-19 relief totaling $6.2m”. Jack Dorsey also reportedly donated $10m to Jay Z’s nonprofit, ‘Reform Alliance’, in May 2020. This relationship set up the groundwork for the TIDAL acquisition to be made. As the saying goes, “It’s not what you know; it’s who you know”.

What’s powerful about this partnership is that here we have two titans operating in different fields, yet partnering together. To me, this shows the importance of networking and establishing relationships and partnerships across the aisle, and across fields and sectors. Too many times, people chase those who are ahead of them, rather than looking for those who are running beside them. People, often, also only care about establishing relationships with people in their field or who share their background; but if Jay had only sought to hang with rappers or people in the entertainment or fashion sector, this deal might never have gotten done.

Have A Plan

This case also shows the importance of market analysis and business planning, as an owner and operator, and particularly as far as investors are concerned. In this case, due diligence and proper business planning were important to the shareholders who filed the lawsuit. Although the Court ultimately decided that Block’s board didn’t act in bad faith, the shareholders pointed to the fact that, among other things, “the artist commitments, which formed the basis for at least half of management's valuation of TIDAL,” were not legally enforceable, meaning that those artists could leave at any time and TIDAL could do nothing about it.

Additionally, the shareholders pointed out that Block had not created any “near and long-term plans for integrating TIDAL into Block’s business”, meaning TIDAL would possibly continue on the same financial trajectory for the foreseeable future.

Now, my point here is not to say whether this was a good or bad deal; my point is to point out what investors expect from businesses; and what may also be profitable for businesses, namely, business planning, due diligence, and market analysis.

The point is, for all of us, whether we’re business owners, executives, managers, individual contributors, or investors, it’s important to understand our fields, the markets we operate in, competitive forces and competition, and how we plan to succeed. That can get very detailed, and the more information we have, the better (to a degree); but, at a base level, we all need to have a plan

Mike Tyson once said, “Everyone has a plan until they get punched in the mouth,” meaning plans often don’t turn out the way we expected. So we have to be ready to pivot, but what planning does is it structures our thinking and disciplines our operation so that we can pivot once presented with new information.

Thanks for reading.