It’s been a while since I’ve written an article so let’s jump right into it.

I was thinking about 360 deals today and came up with the acronym M.A.C.K.

M.A.C.K. stands for Money Always Calls Kings.

A King is a ruler, someone who governs over territories and has mastery over a domain. In our modern age, it speaks to domain expertise, and is a call to truly understand our domains (fields of occupation). In a world where lines have become blurred and business sectors have become increasingly specialized, more work is necessary to understand where we can fit in and exercise mastery.

..or as they say the riches are in the niches.

And that’s what this article is about. As we’ll see, it’s important to understanding how we can exercise mastery in fields that are ever being disrupted.

But we’ll get back to that..

Return of the Mack

In 1996, two years after I moved to America, British singer, Mark Morrison, released a song called “Return of the Mack”. It went platinum several times; was named one of the ‘Top Songs of the 90s’ and ‘500 Best Pop Songs of All Time’ by Billboard; and, the last time I checked, it’s been streamed over 250 million times.

But what does it mean?

In urban parlance, a “mack” is ahh.. someone who is good with women; as opposed to what someone might, today, call an “incel” a/k/a someone who might be smart, but hasn’t learned how to translate their intelligence into luck with women.

It’s kind of like the movie “What Women Want”, with Mel Gibson. He thought he knew everything and had it all together; but it wasn’t until a freak accident gave him the ability to read women’s minds that he realized how wrong he’d been.

Now that you know I like romantic comedies, you might be wondering what this has to do with the 360 deal?

I’m glad you asked.

An issue I see in the startup world, music tech for example, is that founders often create apps, products and services to solve problems that don’t exist or aren’t primary concerns for practitioners within the field; as opposed to looking to understand the field and the problems within the field; and only then creating solutions for those problems and pain points.

Further, in music specifically, we’ve seen a rise in the use of data analytics to forecast “hits” and “superstars”; but this has not necessarily led to more success in terms of breaking artists. As I’ve covered before, we’ve seen a a wave of record label signings that were based on TikTok and algorithmic trends but which didn’t translate into bonafide success for those artists. Rather, it was mainly a play to leverage streaming, streaming royalties, and the labels licensing agreements with TikTok and the DSPs; but, as The Financial Times detailed, it may have led to an over reliance on streaming:

Out of the 184mn total audio tracks available, more than 150mn songs received only 1,000 streams or fewer in 2023, according to Luminate. Some 80mn songs received 10 streams or less. And within that group, more than half — some 46mn songs — received zero streams.

And that’s not to say data is important; or that I’m suggesting that labels and companies not use data analysis in their businesses.

But I am suggesting that it’s a balance.

For example, I recently had a convo with a friend who thinks she’s faster than me and our convo went something like this..

After this challenge from my friend, I got back in the gym. But on my first try sprinting, I pulled my hamstring… (I’m 36 years old).

…still faster though

Anyway, the point is, I believe it takes both. You need data, at least eventually, to validate your claims; or else what else are you relying on?

In other words, you need results.. that’s obvious.

But the issue is sometimes the results come before the hard data; or better yet said, sometimes when you’re starting there is no data. If that weren’t the case then there would be no such thing as entrepreneurial disruption and people wouldn’t be able to make lots of money from ignoring traditional convention, seizing unforeseen opportunities, and exploiting pent up demand.

Be fearful when others are greedy and be greedy when others are fearful

Warren Buffett

In the case of streaming, we now see the major labels looking to reorient the ship. In another Financial Times article titled ‘The music industry is suffering from a streaming hangover’, the publication reports that the labels “have spent much of this year plotting a ‘superfan’ offering on Spotify and other streaming platforms, that would charge the most ravenous fans more money in exchange for perks such as early access to music or merchandise”.

This is in addition to other moves such as:

These ‘superfan’ offerings and moves, in my view, represent the return of the 360 Deal.

Return of the 360 Deal

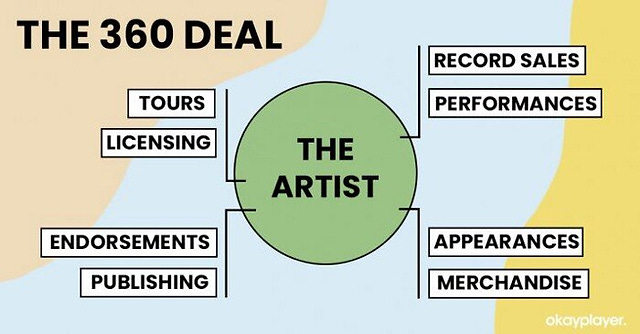

The 360 Deal is an ancillary rights deal, it essentially allowed labels to participate in additional areas of revenue, apart from music royalties and sales; such as merch, performance, and appearance revenue. The 360 deal was largely born out of the music industry’s post-Napster recession, and the logic was two fold: (i) labels needed other ways to generate revenue and recoup their investments; and (ii) the reasoning that if music labels were somewhat responsible for the generation of revenue in ancillary areas then they should participate in those streams; particularly where there was not much ROI in traditional streams.

The problem, outside of general artist / label relationship woes, was that if the label didn’t invest as much, or anything, into ancillary ventures as the artist then many felt it was an overreach; or if artists didn’t make much money from their music business; but still had to split 360 revenue with the labels then this also led to dissatisfaction.

In reality, though, a 360 deal is a form of joint venture or joint participation and is not that uncommon; but because the music business is upside down world (in many ways) the 360 deal sticks out.

The point is, labels are now looking to reinstate the joint venture/ participation model; and my message is that this isn’t something that should scare artists nor artist teams but, rather, should excite and energize them.

Why?

Remember the acronym? Money Always Calls Kings

These companies are now looking for places to deploy their capital and that capital is looking for people who have proven domain expertise and can multiply money outside of the traditional revenue streams. In other words, the music business is looking for artists and artists teams who have the ability to bring something to the table other than promises of streaming revenue and dancing/rapping on conference tables.

At the end of the day, the music business is just private equity with vibes.

For example, today’s record or distribution agreement is simply a collateralized deal in which the label or distribution company provides money to an artist and, in return, holds an asset (the artist’s music) for a certain number of years until the company (hopefully) makes their money back. The amount of money given, and years required, goes through the company’s algorithmic matrix, financial analysts and accountants to make sure that the company has factored in an expected profit.

I see these deals all the time, and that’s really what it is; and negotiating them is fairly easy if you crunch the numbers.

Additional example: Concord Music, one of the largest music companies in the world, is owned by Michigan’s pension fund (around 93%).

So on and so forth..

So, if music is a business and the 360 deal is a private equity investment then artists and their teams should build with this in mind. It doesn’t mean you have to take the deal, but it should reveal to you where the money is and is going.

SAUCY

There’s a book I haven’t finished called ‘Teams of Teams’. It talks about how small, but equipped, skilled and experienced teams can do great things

This is the same for the music business and the creative economy in general, including sports. Teams may not need to be as large as before; but they do need to be built for success. Meaning they need to be filled with highly qualified and specialized people who can do more with less.

How does this happen?

Understand your role. What do you bring to the table? Over-index on that and stop trying to do what you see everyone else doing just because you think that’s what you should be doing. People routinely get it wrong.

Understand what you need from a team. Again, see the above.

Understand the landscape of the business. There’s a famous saying, “who are you going to believe: me or your own eyes? Yes, invest in yourself and learn from others; but also learn to trust in what YOU see. God gave you eyes for a reason.

In closing: It’s easier said than done. Which is why I don’t like posting a bunch of random statistics. At the end of the day, you either make and/or do something people want and/or need; or you don’t.

But the truth is that when you look at the numbers and what’s happening in this space and others (for better and worse), they look crazy; and any artist, athlete, or influencer, with a modicum of “success”, who isn’t actively looking to build a business around their artistry and influence has their head in the sand (in my humble opinion).

At the end of the day, you can make art for the sake of art alone; or you can make money from your art. It’s up to you, it’s a free world, no judgment.

But let me ask you a question, what is the difference between a Picasso and every other talented artist’s painting? The answer is best told by this story:

According to the legend, Picasso was at a Paris cafe, doodling on a napkin when an admirer, recognising the artist, approached him and asked if she could purchase his drawing.

Upon completing the napkin sketch, Picasso asked for a million Francs in exchange for the sketch. The admirer was taken aback by this seemingly exorbitant request. After all, it had taken Picasso just a few minutes to create the drawing. In her eyes, the value of the sketch appeared disproportionate to the time it took to create it.

Picasso, however, responded with a phrase that has since become an enduring testament to his artistic journey and mastery: "My dear, It took me a lifetime to be able to draw this sketch."

Let me shake this rust off.. until next time.

welcome back, king